how much is capital gains tax in florida on stocks

Income over 445850501600 married. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it.

Income Types Not Subject To Social Security Tax Earn More Efficiently

Special Real Estate Exemptions for Capital Gains.

. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet. Maximum capital gains taxes is 20 38 Net Investment Income Tax ObamaCare surcharge state taxes based on where you live. Income over 40400 single80800 married.

If youre in the 22 tax bracket thats the rate that will apply to the short-term capital gain. Florida has no state income tax. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more. Tax Rates on Capital Gains Most net capital gains are subject to a tax rate of no more than 15 percent for the majority of taxpayers. However you may only pay up to 20 for capital gains taxes.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. That applies to both long- and short-term capital gains. However depending on how a sellers accountant can interpret the situation that may not be the case.

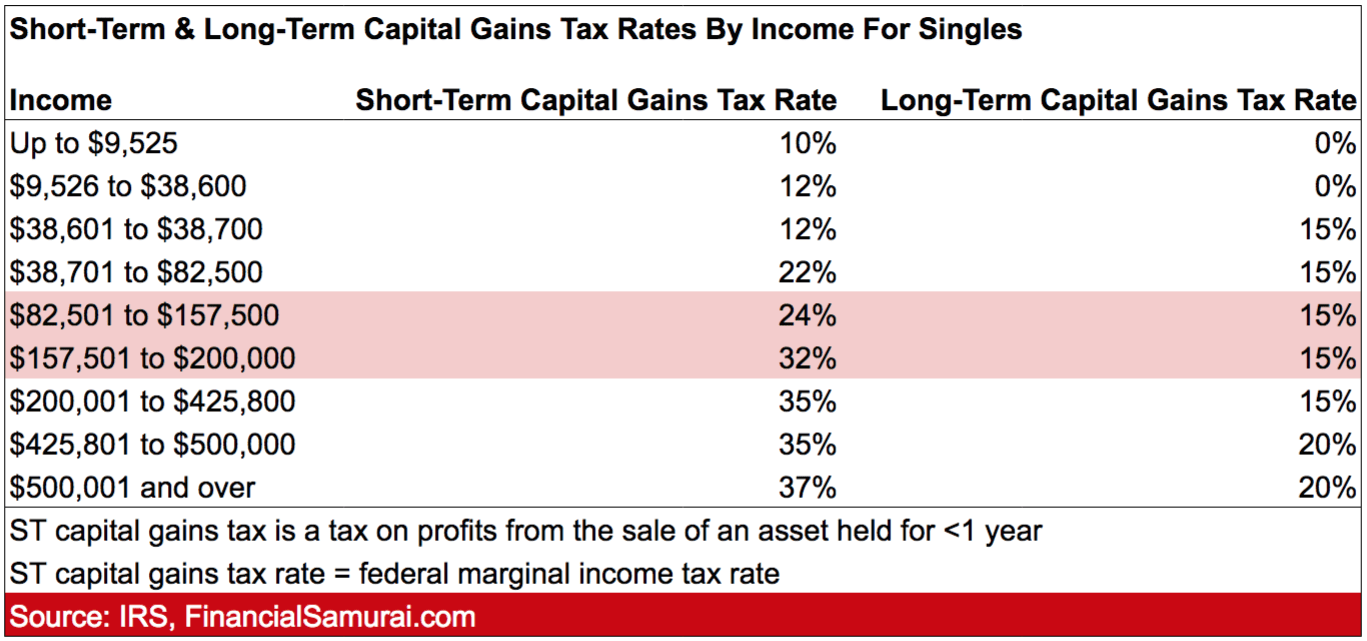

The capital gains tax is based on that profit. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status. Individuals and families must pay the following capital gains taxes.

In others it might be taxed as much as 13. Ncome up to 40400 single80800 married. The percentages for Capital Gains taxes can also change.

Hawaiis capital gains tax rate is 725. Capital Gains Tax Rate. How Much Is Capital Gains Tax In Florida On Stocks.

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. There is currently a bill that if passed would increase the capital gains tax in. If your taxable income is less than or.

Specifically New Hampshire imposes a 5 tax on dividends and interest while Tennessee charges a 6 tax on investment income in excess of 1250 per person. Dont forget to pay your fair share If you lost money still. And unlike ordinary income taxes your capital gain is generally determined by how long you hold an asset before.

They are generally lower than short-term capital gains tax rates. To determine how much you owe in capital gains tax after selling a stock you need to know your basis which is the cost of the stock along with any reinvested dividends and commissions paid. Ncome up to 40400 single80800 married.

In this case the tax liability will be 1100 5000 times 22. Includes short and long-term Federal and State Capital.

Capital Gains Tax What Is It When Do You Pay It

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax In Kentucky What You Need To Know

Capital Gains Tax Calculator 2022 Casaplorer

How High Are Capital Gains Taxes In Your State Tax Foundation

Long Term Capital Gains Tax How Much Tax Will I Owe Taxact Blog

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

How To Pay 0 Capital Gains Taxes With A Six Figure Income

12 Ways To Beat Capital Gains Tax In The Age Of Trump

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Article What Is The Capital Gain Tax What Is The Capital Gain Tax

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation